On the basis of new technology services such as banking, or even banking (e.g. transfer payments), may have organizations which are not banks, including telecommunications firms. The latter, as a rule, are oriented not to the conduct of individual transactions, and offer you a customized package for each client.

In these circumstances, banks in order to maintain competitive prices for services are constantly struggling to reduce costs, implementing the scheme of cost control and performance review. However, the desire to meet the demands of the time forces them to increase spending on the introduction of new information and telecommunication technologies, develop in addition to the existing branch network, electronic distribution channels. Formed the contradiction between the desire to save and the need for major expenses.

We have given only a few arguments in favor of the view that banking in the era of globalization is significantly changing. If you try to highlight the causes of these changes, we first must mention the following:

- The development of transnational corporations and their branches in all countries of the world has led to an increase in their need for adequate banking facilities and has provoked the emergence of new non-traditional banking services.

- Non-financial sector of economy, financial and banking system of the national economic systems are becoming more uniform when working in the domestic and world markets. This leads to the approximation of the rules governing the internal and external economic transactions.

- The national banking system, which are designed to accumulate and redistribute financial resources within national economic systems are in ever-increasing dependence on the international capital market, which in the era of globalization has become an independent factor in the development of the world economy.

- National monetary policy (that is, banking of the Central Bank) is having increasing influence of the increasing expansion of corporations, banks and other financial institutions in the global capital market, including in the sector of direct investment.

- These causes are 1 and 4, as well as a whole range of reasons and circumstances, which are indicated by M. Delyagin [6] , hit the frame of the national economy and make it more open (to weak economic systems, this has very adverse consequences, whereas a strong economy win).

- The consequence of the us fifth reason is the changing nature and the main participants of competition in the banking market. Very intense is the competition with non-resident banks in the advanced economies [7] .

- The increase in the share of international operations in the total volume of banking operations.

- The result of the seventh causes a change in the structure of income and, therefore, "the geography of economic interests" of the banks.

- Standardization of banking supervision.

Banking business under the impact of globalization acquires new features , namely:

- the reduction in the share of traditional banking operations in favor of increasing the new, qualitatively meet the changed demands of customers. Quick and continuous improvement of banking products and services and their channels of promotion on the basis of modern information and communication technologies, give the banking business innovative character;

- the consolidation of the banking capital in the national and international scale. The increase in the size of banks through merger and acquisition, as well as their cooperation with other financial institutions aim to strengthen the competitive position at the national level and conquer new spheres of influence international;

- the main objective of Bank management is to increase market value (capitalisation) of the Bank as businesses. In the US, European and some Asian countries, has confirmed the view that the increase in the market value of the Bank and the growth of capitalization of the banking industry as a whole ensure implementation by banks of their social functions and the preservation of their jobs, which meets the needs of economic growth.

The process of financial globalization and the formation of a "global banking industry", according to some economists , contribute to the standardization of national banking systems and the emergence of a single, dominant models of the Bank.

All this problems may solve project Bank Account Based Blockchain(BABB):

The World Bank for the Micro-Economy

A decentralised banking platform that leverages blockchain, AI, and biometrics technologies to offer anyone in the world access to a UK bank account for peer-to-peer financial services.

The account is managed via a smartphone app and provides access to a decentralised payment card. In addition, partnerships with central banks allow for the integration and issuance of other digital currencies around the world, further stimulating local micro-economies and expanding the reach of the BABB solution and its underlying BAX token. BABB is already an FCA Authorised Payment Institution (API) and will be applying for a Banking licence in early 2018.

Black Card

The Black Card bridges the divide between the digital world and the physical world. It is a secure payment card that links directly with your BABB bank account via a secure QR code or NFC tag. It allows both a debit-like functionality, and can also be issued as a pre-paid card for your friends and family.

How it works

Retailers can accept payment using the BABB card by simply downloading the BABB app and scanning the QR code or via NFC. Payment is made instantly into the retailer's bank account and the funds can be used immediately.

Where it works

With the Black Card you are able to spend your BAX in shops and peer-to-peer. Payments can be made instantaneously, anywhere in the world or for online shopping.

Accessibility

Billions of individuals do not have access to card services. The costs associated with facilitating traditional card payment services are prohibitively expensive. However, the Black Card operates independently of the legacy system. Therefore, transactions are made cheaper, faster, and more efficient; giving everyone access to a payment card linked to their bank account.

Security and convenience

No personal information is stored on the card itself. If you lose your card, you can easily disconnect it from your bank account, preventing anyone else from using it – all from your smartphone. If you find the card again, simply scan the QR code via your BABB app and it reconnects to your BABB bank account.

Availability

New cards will be available very cheaply in shops and from major online retailers with next day delivery. Alternatively, pick up a spare from a friend, scan the QR code with your BABB app and you are good to go.

TOKEN SALE COMING SOON

BAX is an Utility token that powers the BABB platform. All services, fees and licensing costs on the BABB Platform are paid with BAX, and our Mobile app makes it easy to acquire BAX at any time without taking additional steps or affecting the user experience.

It can also be used for other purposes, such as onboarding and offboarding funds to 3rd party exchanges, fundraisings and cross-currency conversion with improved liquidity.

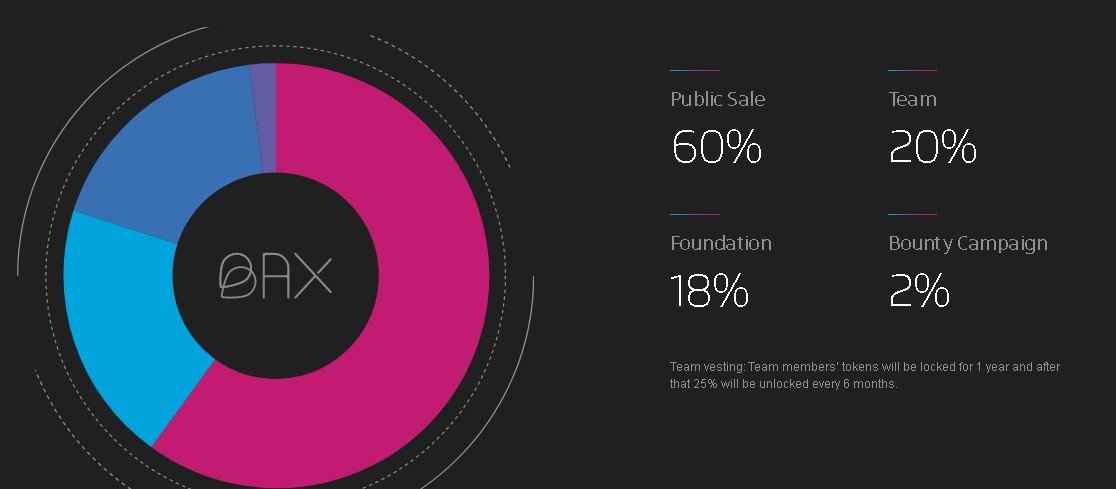

TOKEN DISTRIBUTION

Site Click HERE

Whitepapper Click HERE

Bitcointalk Click HERE

Twitter Click HERE

Facebook Click HERE

My bitcointalk account Click HERE

Comments

Post a Comment